Somewhere in the English midlands during the reign of Edward the Confessor, there lay the Kingdom of Mercia. It was 1054 or thereabouts and Leofric, Earl of Mercia, had a problem. Leofric was the kind of ruler who never saw a tax he didn’t like, his latest the “Heregeld”, a tax to pay for the King’s bodyguard. Leofric’s wife was Godgyfu in the Olde English, meaning “Gift of God”. Today we call her “Godiva”. Take pity on the people of Coventry, she said, they are suffering under all this oppressive taxation.

A guy can only take so much, even if he is an Earl. Tired of his wife’s entreaties, Leofric agreed to repeal the tax on one condition; that she ride a horse through the streets of town, dressed only in her birthday suit and her long hair. Lady Godiva took him at his word. She issued a proclamation that all townspeople stay indoors and shut their windows, and took her famous naked ride, through town.

The story probably isn’t true, any more than the one about Tom, the guy who drilled a hole in his door so he could watch and lost his sight at what he saw. But a thousand years later, we still use the term “Peeping Tom”.

Tax revolts are nothing new. Neither are the many and sometimes novel ways that politicians have concocted to fleece those of us who pay their bills.

On December 31, 1695, King William III decreed a 2 shilling tax on each house in the land. Not wanting to miss an opportunity to “stick-it-to-the-rich”, there was an extra tax on every window over ten, a tax that would last for another 156 years.

It must have been a money maker, because the governments of France, Spain and Scotland followed suit with similar taxes. To this day, you can see homes where owners have bricked up windows, preferring darkness to the payment of yet another tax.

Czar Peter I returned from a trip to Europe in 1698, hot to “modernize” Russia. All those European guys were clean shaven, so Peter instituted a tax on beards. No, really. When you’d paid your beard tax of 100 Rubles, (peasants and clergy were exempt), you had to carry a “beard token”. Two phrases were inscribed on the coin: “the beard tax has been taken” and “the beard is a superfluous burden”. Failure to shave or pay the tax might lead to your beard being forcibly cut off your face. Some had theirs pulled out by the roots by Peter himself, all 6-foot 8-inches of him.

In Holland, they used to tax the frontage of a home, the wider your house the more you paid. If you’ve ever been to Amsterdam, narrow houses rise several stories, with hooks over windows almost as wide as the building itself.

Those are used to haul furniture up from the outside, since the stairways are too narrow. The narrowest home in Amsterdam can be found at Singel #7, the house barely wider than its own front door.

You can find the same thing in the poorer quarters of New Orleans, where the “shotgun single”, a home so narrow you can fire a shotgun in the front door and pellets will go out the back, and the “Camelback” (second story out back) are the architectural results of tax policy.

England has a “Telly Tax” paid in the form of a television license. There’s good news though; you only have to pay half if you’re legally blind. This is in addition to the council tax, income tax, fuel tax, road tax, value added tax, pasty tax, national insurance, business rates, stamp duty, and about a thousand other taxes. But hey, the health care is free.

In Canada, makers of children’s breakfast cereal are tax exempt if their cereal contains a free toy. The exemption is limited to toys not containing “beer, liquor, or wine.” Good to know.

Sweden has had a “name ordnance” in effect since 1901, requiring parents to obtain blessings from the government for what they name their children.

In 1991, Elisabeth Hallin and Lasse Diding gave birth to a baby boy. The couple failed to register a name by the age of five and received a fine of 5,000 Kronor, equivalent to $1,206, US. The pair petitioned the court in 1996 to call the kid Brfxxccxxmnpcccclllmmnprxvclmnckssqlbb11116 (pronounced “Albin) and failed to gain permission. The couple then tried to change the boy’s name to “A” (also pronounced Albin). The court rejected that one too, and upheld the fine.

Tennessee has a “Crack Tax” you’re supposed to pay on illegal drugs (don’t ask), and Massachusetts will charge you a “meals tax” on five donuts, but not 6. The state of Illinois taxes candy at a higher rate than food. Any item containing flour or requiring refrigeration is taxed at the lower rate, because it’s not candy. So yogurt covered raisins are candy, but yogurt covered pretzels are food. Baby Ruth bars are candy, but Twix bars are food. Get it? Neither do I.

The Roman Emperor Vespasian, who ruled from 69 to 79AD, levied a tax on public toilets.

When his son, the future Emperor Titus wrinkled his nose, Vespasian held a coin under the boy’s nose. “Pecunia non olet”, he said. “Money does not stink”. 2,000 years later, his name is still attached to public urinals. In France, they’re called vespasiennes, in Italy vespasiani. If you need to piss in Romania, you could go to the vespasiene. History fails to record the inevitable push-back on Vespasian’s toilet tax, but I’m sure that ancient Romans had to look where they walked.

Environmentalists in Venice, Italy have been pushing a tax on tourism, claiming that the city’s facing “an irreversible environmental catastrophe as the subsequent increase in water transport has caused the level of the lagoon bed to drop over time”. Deputy mayor Sandro Simionato said that “This tax is a new and important opportunity for the city,” explaining that it will “help finance tourism”, among other things. So, the problem borne of too much tourism is going to be fixed by a tax to help finance tourism. I think. Or maybe it’s just another money grab.

As of December 2015, state and territory tax rates on cigarettes ranged from 17¢ per pack in Missouri to $4.35 in New York, on top of federal, local, county, municipal and local Boy Scout council taxes (kidding). Philip Morris reports that taxes run 56.6% on average, per pack. Not surprisingly, tax rates make a vast difference in where and how people buy their cigarettes. There is a tiny Indian reservation on Long Island, measuring a few miles square and home to a few hundred people. Tax rates are close to zero there, on a pack of butts. Until recent changes in the tax law, they were selling 100 million cartons per year.

If all those taxes are supposed to encourage people to quit smoking, I wonder what income taxes are supposed to do?

Back in 2013, EU politicians were discussing a way of taxing livestock flatulence, as a means of curbing “Global Warming”. At that time there was an Australian ice breaker, making its way to Antarctica to free the Chinese ice breaker, that got stuck in the ice trying to free the Russian ship full of environmentalists. They were there to view the effects of “Global Warming”, before they got stuck in the ice.

Honest, I wouldn’t make this stuff up.

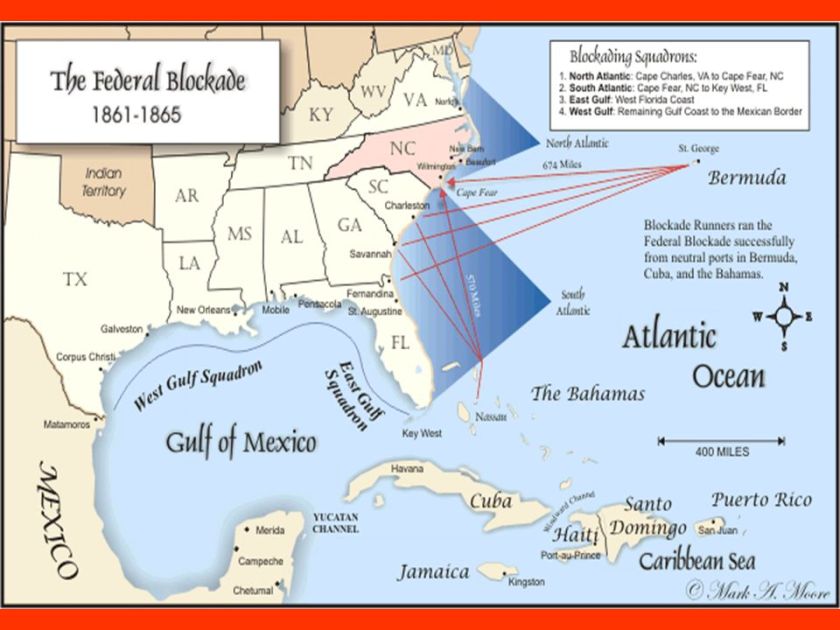

President Abraham Lincoln issued a proclamation soon after taking office, threatening to blockade southern coastlines. It wasn’t long before the “Anaconda Plan” went into effect, a naval blockade extending 3,500 miles along the Atlantic coastline and Gulf of Mexico, up into the lower Mississippi River.

President Abraham Lincoln issued a proclamation soon after taking office, threatening to blockade southern coastlines. It wasn’t long before the “Anaconda Plan” went into effect, a naval blockade extending 3,500 miles along the Atlantic coastline and Gulf of Mexico, up into the lower Mississippi River.

Even at the Constitutional Convention, delegates expressed concerns about the larger, more populous states holding sway at the expense of the smaller states. The “Connecticut Compromise” solved that problem, creating a bicameral legislature with proportional representation in the lower house (House of Representatives) and equal representation of the states themselves in the upper house (Senate).

Even at the Constitutional Convention, delegates expressed concerns about the larger, more populous states holding sway at the expense of the smaller states. The “Connecticut Compromise” solved that problem, creating a bicameral legislature with proportional representation in the lower house (House of Representatives) and equal representation of the states themselves in the upper house (Senate).

You must be logged in to post a comment.